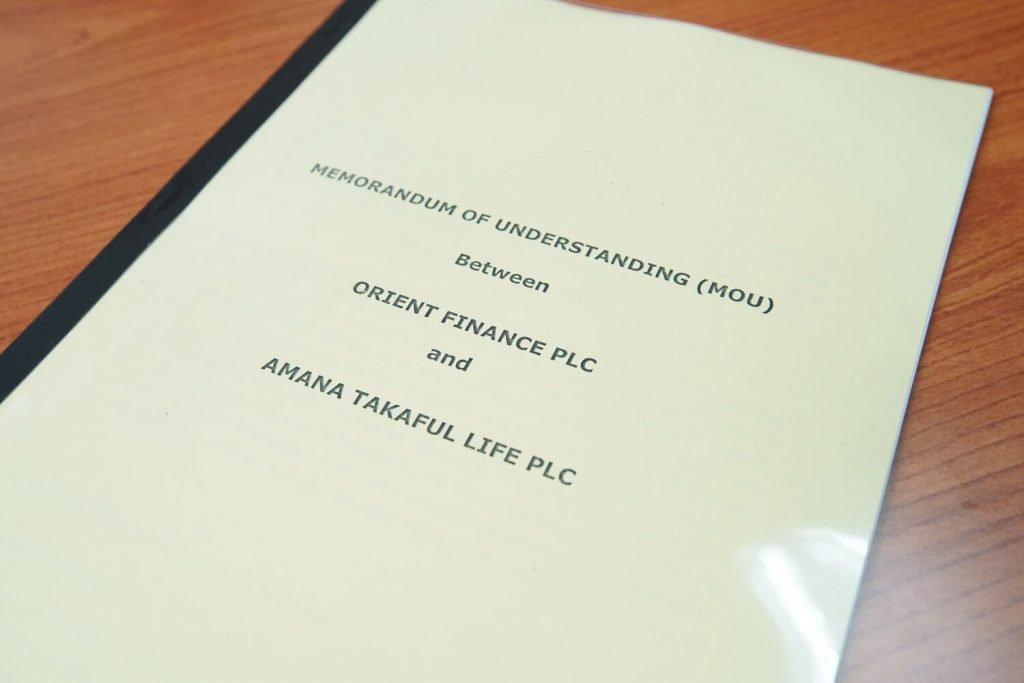

Amana Takaful Life Insurance, which excels in providing innovative and tailor-made long-term insurance solutions has partnered with Orient Finance PLC (OFP), a top-player in the finance sector with successful operation for over four decades. The collaboration, signed recently as a Memorandum of Understanding (MoU), brings protection benefits of life insurance and critical illness insurance from Amana Takaful Life, to fixed depositors of OFP.

The MoU was signed by Gehan Rajapakse, Executive Director/CEO, Amana Takaful Life Insurance PLC, and K. M. M. Jabir, Executive Director/CEO, Orient Finance PLC on the 23rd of November, in Colombo.

Elaborating on the new collaboration, the CEO of Amana Life, Gehan Rajapakse said: “We are pleased to partner with Orient Finance PLC, a highly reputed finance company in Sri Lanka with a history of four decades of operations. Depositors of such a reputed finance institution belong to multitudes of demographic and geographic segments. We are pleased to be entering into this partnership, which will enable us to serve the diverse segment Orient Finance fixed deposit holders. OFP’s choice of Amana Life is a clear testimony to our brand strength, as a reliable provider of quality insurance to a wide range of clientele. We are looking forward to extend our best insurance services to Orient Finance’s clientele.”

The Amana-Orient MoU implements a unique and exclusive value addition to the Fixed Deposit account holders of OFP. At the time of opening a new FD account each account holder is eligible for a life insurance plan, offered at a special premium rate. Each OFP FD account holder will be eligible for two covers; Basic Life Cover and Critical Illness Cover. Policy values will be decided based on the total value of the fixed deposit placed at Orient Finance PLC. All customers receiving this benefit will be receiving a specially designed co-branded insurance card that indicates their life insurance cover.

CEO Gehan Rajapakse further adds: “Amana Life, being a fully-fledged long-term insurance provider, builds a culture of ensuring claims to all its clients. Our relationships are completely based on trust and mutuality. Hence we highly value the trust of our clients and partners, at all times.”

About Amana Takaful Insurance:

Amana Takaful Insurance pioneered a unique concept of Insurance (Takaful) in Sri Lanka which is based on customer-centricity and ethical practices, and has today become a fully-fledged insurance company in Sri Lanka. It is compliant with the statutory provisions of Regulation of Insurance Industry (amendment), Act no. 3 of 2011 which stipulates all composite insurance providers to segregate long-term and general insurance businesses. Amana Takaful Insurance offers a complete range of Life and General insurance solutions as well as tailor-made health insurance policies to suit the overall health needs of diverse segments of society.

#ENDS#